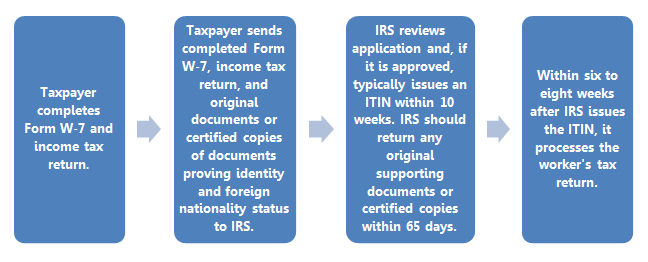

Itin Application Status Check - If you file during peak processing periods (january 15th to april 30th) it may take up to 11 weeks. If you have not received any notification at the end of that time, call the irs to find out the status of your application.

Irsnews On Twitter Check If Your Itin Needs To Be Renewed W Irs Httpstcowot13mkfp1

While itins do not technically have expiration dates, they will need to be renewed every five years.

Itin application status check. The irs provide a facility whereby you can check the status of your application. Is there a way i can check the status of my itin? Apply for a new itin or 2.

Millions of people were granted this document, which resulted in a sharp increase in the number of personal income tax declarations (form 1040) during the second half of 1990s. Your return will be processed after that date. It typically takes the irs about 7 weeks to notify you of your itin application status.

For check itin status you have to call: 8) where can i find information about my application? The irs mail the confirmation to the postal address you specified when the irs completed your itin application.

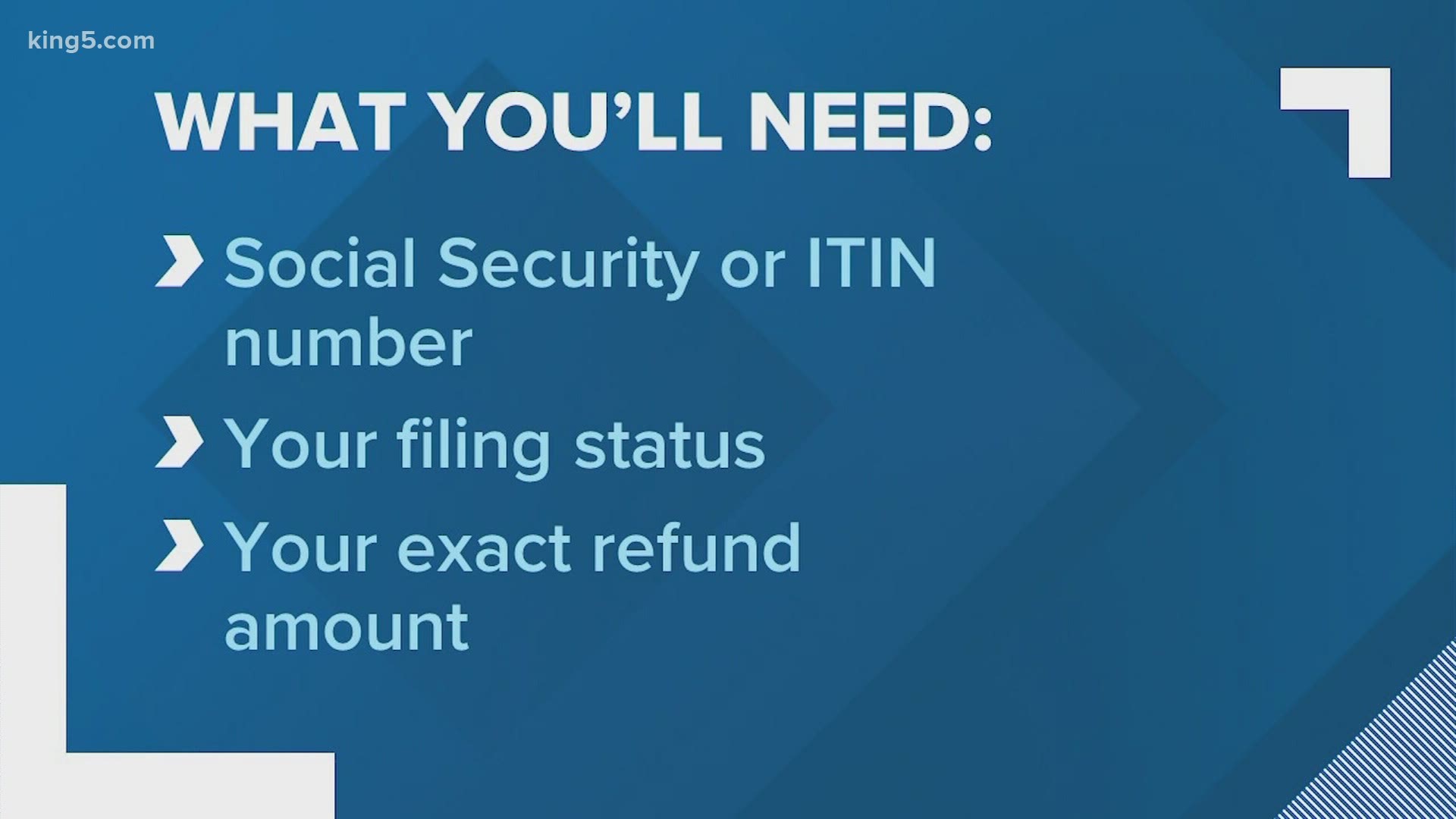

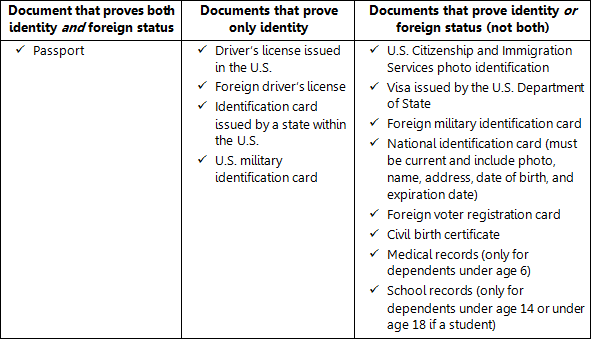

How to check itin status? If you need to file a tax return in 2021 and your itin has expired or will expire before you file in 2021, irs recommends you submit your renewal application now to prevent potential delays in the processing of your return. What documents are acceptable as proof of identity and foreign status?

Tax return, it will be processed and treated as timely filed, but without any exemptions and/or credits claimed and no refund will be paid at that time. If you use an expired itin on a u.s. List of designated tacs that offer itin document authentification services:

In this way, there will be no need for cases such as submitting a foreign status document and passport. The processing time for an itin, as stated by the irs, is usually six to eight weeks. Be prepared to wait on hold and to be transferred several times.

I hope you remembered to sign everything (live signature), check correct boxes for any dependent(s) based on type, remembered additional required documents for dependents, did not send expired or unsigned docs, etc. However, if you are applying for your itin through an irs certifying acceptance agent, then your agent has a direct phone line with the irs itin department in which they can contact to check for an update in regards to your itin application. You should check the application status intermittently and contact the irs if you haven’t heard from them after six weeks.

If you don’t use your itin for three consecutive years, the irs will then consider it defunct. Please enter alphabets and digits only and characters are case sensitive. If you are applying for an itin on your own, then there is no official way for you to be able to check on the application’s itin status.

If you qualify for an itin and your application is complete, you will receive a letter from the irs assigning your tax identification number usually within six weeks. It's more likely your status is being held up by the people that process returns, not the itin people since you would have been required to file your 1040 and application for itin at the same time. Track your pan/tan application status.

If your english is not good enought, try to find somebody who can help you. Why did irs revise the itin application process? For the latest mailing instructions, please visit:

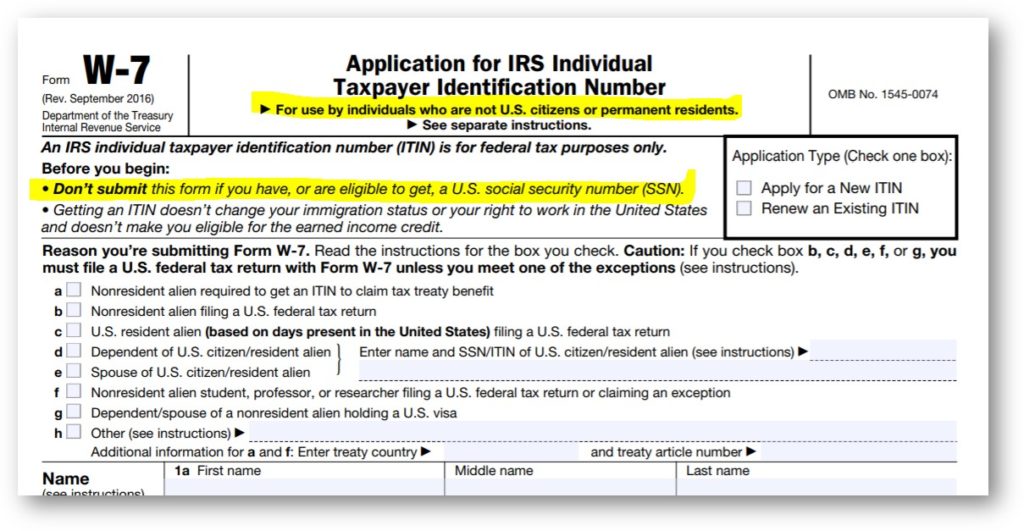

Irs streamlined the number of documents the agency accepts as proof of identity and foreign status to obtain an itin. I would like to remind our readers of a law was adopted in 1996 allowing the irs to grant all interested parties, including those without the status of a legal immigrant, an individual taxpayer identification number (itin). Apply in person at a designated irs taxpayer assistance center (tac).

It may take longer, especially during peak months like january and march. The irs revised the itin application process to help ensure itins are used for their intended tax administration purposes. If you qualify for an itin and your application is complete, you will receive a letter from the irs assigning your tax identification number, usually within six weeks.

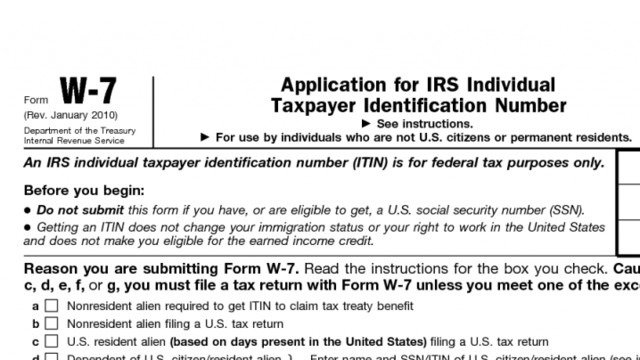

Please select type of application: Who can help me apply for my itin? Next to that box, you will have to check if the purpose of filling out the form is to 1.

321263 Irs Individual Taxpayer Identification Number Itin Real-time System Rts Internal Revenue Service

Itin Individual Taxpayer Identification Number For Taxes - Myexpattaxes

Taxpayer Advocate A Twitter Check Your Itin Status Before Dec 31st To Renew Your Individual Taxpayer Identification Number And Avoid Irs Delays This Upcoming Tax Season Httpstcos9eax38qct Httpstcojb0sde6azv

Heres How To Track The Status Of Your Tax Return From The Irs King5com

321263 Irs Individual Taxpayer Identification Number Itin Real-time System Rts Internal Revenue Service

321263 Irs Individual Taxpayer Identification Number Itin Real-time System Rts Internal Revenue Service

New Irs Process For Itin Renewal Hr Block

The Facts About The Individual Taxpayer Identification Number Itin American Immigration Council

Individual Taxpayer Identification Number - National Immigration Law Center

You Cant Use An Itin To Build Credit And Credit Scores

Know About Individual Taxpayer Identification Number Itin Number By The Tax Planet - Issuu

W-7 Itin Application - Vita Resources For Volunteers

Individual Taxpayer Identification Number - National Immigration Law Center

What Is An Itin How To Apply For Itin From India Or Anywhere In The World Getting Itin Number -